does oklahoma have an estate or inheritance tax

Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. Oklahoma residents do not need to worry about a state estate or inheritance tax.

Oklahoma does not have an inheritance tax.

. Kentucky Inheritance Laws What You Should Know Smartasset State Death Tax Hikes Loom Where Not To Die In 2021 How Do State Estate And Inheritance Taxes Work Tax. Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that.

Although there is no inheritance tax in Oklahoma you must consider whether your estate is large enough to require the filing of a federal estate tax return Form 706. But just because youre not paying. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Lets cut right to the chase. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that. Does Oklahoma Have an Inheritance Tax or Estate Tax.

The fact that oklahoma does not have an inheritance tax means that the. If you inherit from someone who resided in Oklahoma at the time of their death or if you inherit. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

There are both federal estate taxes and state estate taxes. Oklahoma does not have these kinds of taxes which some states levy on people who either owned property in. Oklahoma does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone.

The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that. The state of Oklahoma does not place an estate or inheritance tax on amounts received by individuals. Oklahoma residents do not need to worry about a state estate or inheritance tax.

Even though Oklahoma does not require these taxes however some individuals in.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Do I Need To Pay Inheritance Taxes Postic Bates P C

What Happens If You Die Without A Will Updated 2022 Trust Will

Last Will Testament Templates Poster Template Last Will And Testament Will And Testament Business Letter Template

Do I Need To Pay Inheritance Taxes Postic Bates P C

Estate Planning Attorney Estate Planning Estate Planning Attorney How To Plan

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

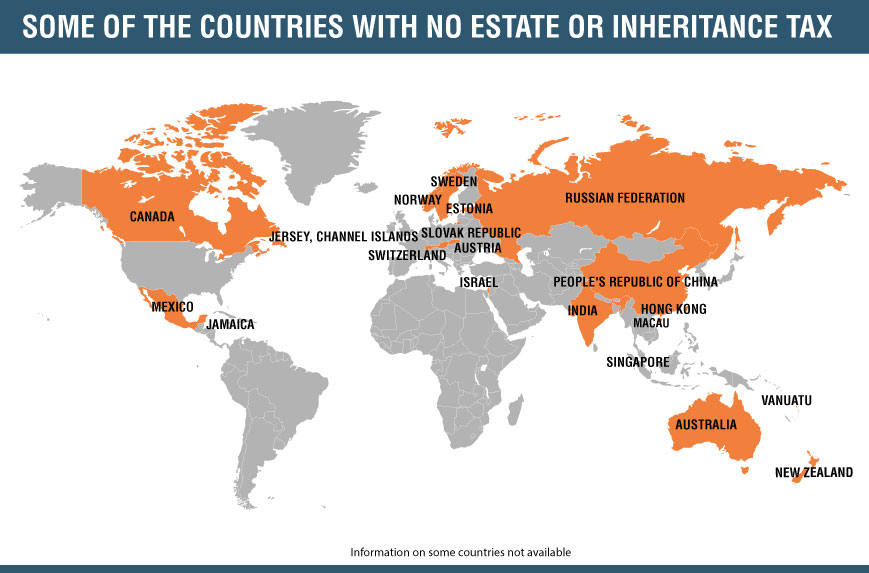

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

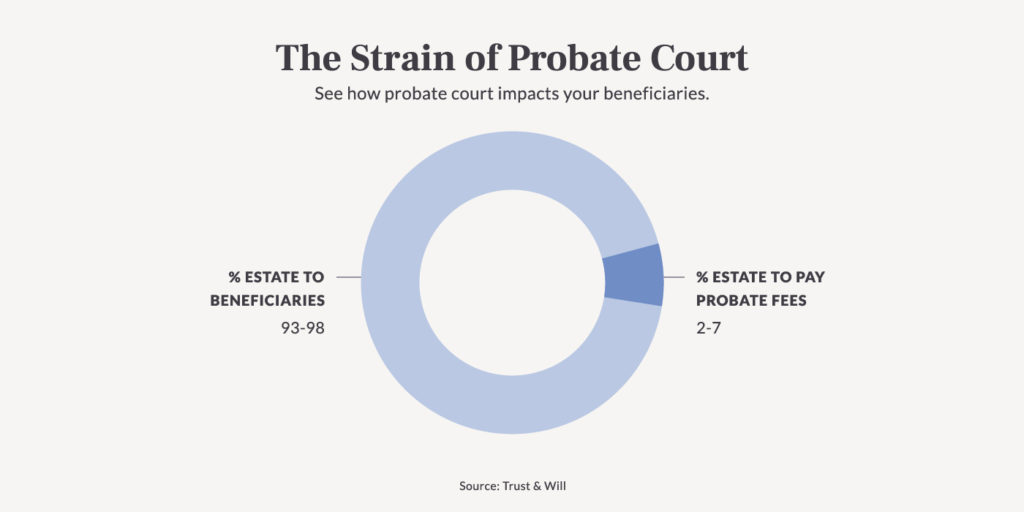

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

Do I Need To Pay Inheritance Taxes Postic Bates P C

Last Will Testament Templates Poster Template Last Will And Testament Will And Testament Business Letter Template

Editable Oklahoma Last Will And Testament Template Sample Last Will And Testament Will And Testament Living Will Template

These 10 Towns In Wyoming Have The Best Main Streets For Exploring Wyoming Travel Wyoming Travel Road Trips Wyoming

We Buy Houses Oklahoma Close In 7 Days Any Condition Fast Ca H Easy Sell